Unlocking maximum potential with AI implementations by setting the proper foundations

Artificial intelligence (AI) has evolved to become an increasingly integrated part of our everyday lives. Before exploring how AI can be implemented and create value in organizations, let’s first examine what AI is and what advancements have enabled its rapid development. AI is an umbrella term in computer science that describes the ability of machines to mimic human intelligence. Under the wide umbrella of AI, we find subfields such as machine learning and deep learning. Machine learning aims to train algorithms on data to make better and better decisions, while deep learning is a more advanced type of machine learning where algorithms are structured in layers, neural networks, to make even better decisions independently. Both methods are based on processing large amounts of data, which is energy-intensive and costly. Thanks to innovative solutions such as specially designed chips and centralized server halls, the prerequisites now exist to develop AI-based solutions cost-effectively. This, along with the new generative AI models, has significantly accelerated the development pace of AI applications.

The key to successful AI implementation is a data-driven organization

Montell & Partners has helped design plans and architecture for an AI system with the aim of ensuring quality and streamlining processes, and our experience is that success with AI is not just about technical conditions. Leaders must dare to make data the core of their business strategy and ensure that the entire organization is equipped and mature enough to use AI in their daily operations. It is a journey that requires change not only in technology but also in corporate culture.

There are several important aspects to consider before an AI implementation. One such aspect is the source code of the tools. Is the AI software developed for commercial use, or is the open-source solution intended for research? Knowledge about the origin of the source code is crucial to avoid legal pitfalls such as breaches of contract or legal disputes, an example of a legal pitfall is adhering to GDPR. When introducing AI, organizations face the choice of developing their own solutions – a costly but tailored process – or licensing developed services adapted for commercial use. Making this decision requires a well-defined strategy outlining the objectives of the AI initiative, along with a thorough comprehension of the various opportunities and limitations presented by different systems. Another critical aspect is data privacy; when data is handled by third-party AI software, one must be aware of where and how this data is stored and processed. This is particularly relevant if the provider has server locations in countries outside the EU, where different data protection laws apply.

Montell & Partners can assist in the AI initiative through consulting and project management

At Montell & Partners, we are ready to support and guide you through the exciting change towards a data-driven future. By understanding the legal frameworks and business considerations, we can help you maximize the benefits of your AI initiative.

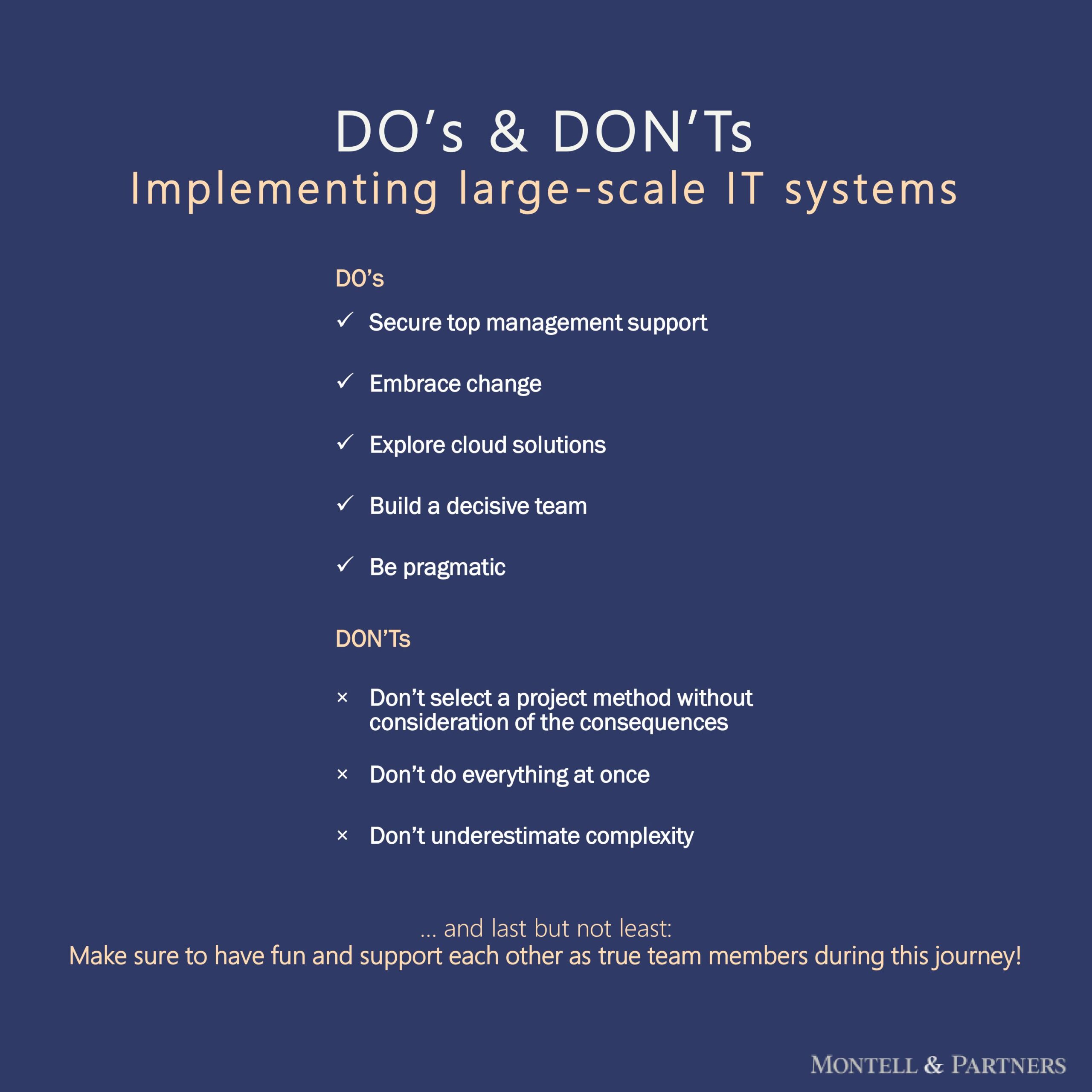

DO’s & DON’Ts – Implementing large-scale IT systems

Implementing large-scale IT systems can seem like an overwhelming task for any organization, especially when working with publicly procured solutions. However, by following the right approach, it can be a highly rewarding experience. Our experienced senior subject matter experts have identified practical tips that have helped our clients achieve their implementation goals successfully.

DO’s

- Secure top management support: It is absolutely crucial to have the backing of top management to drive business transformation within the own organization as well as cultivate a healthy relationship with the solution provider—especially as the project sets the basis for a long period of close collaboration during the later maintenance phase.

- Embrace change: Allow room for scope and requirement changes during the project to adapt to evolving needs and ensure the final solution meets all necessary requirements. Identify and empower early adopters who are motivated to take the lead during the change management process. Be open to new cultures since most of the solution providers are global actors.

- Explore cloud solutions: Consider cloud solutions, which provide benefits such as flexibility, scalability, and cost-effectiveness, to achieve better system performance. Make sure your cloud solution provider has a clear and well-developed implementation approach, as well as best-practice business processes that suit your organization’s needs.

- Build a decisive team: Assemble a team that can take ownership of the project and makes informed decisions to drive results. Often, the best team leader is not necessarily the most knowledgeable team member but the one who excels in decision-making, taking action, and motivating other team members.

- Be pragmatic: Your current IT system is most likely well-suited to all your business needs since years of enhancements and gradual adjustments. Your new IT solution will never be the best fit in all areas of your organization—that is just something you have to accept as a trade-off being part of a much larger journey together with your solution provider.

DON’Ts

- Don’t select a project method without consideration of the consequences: Different methods can significantly impact IT implementation project success. The organization’s needs as well as aspects of public procurement must be considered when structuring, for example, program activities and contractual terms. Alignment between these and the chosen methodology must be assured whether selecting a traditional waterfall approach or a more agile one.

- Don’t do everything at once: Set the foundation in terms of system architecture and core processes before discussing finer areas of process details, routines, and development. This will save time and resources, as well as limit the need for rework later on in the project. During periods of low progress, it can also be effective to make some work streams temporarily inactive to allow resources to focus on the most critical issues.

- Don’t underestimate complexity: IT implementation cannot be assumed to be plug-and-play. It’s essential to have the necessary resources and expertise within the organization to implement the solution successfully. Effective communication with the solution provider—and within your organization—is critical to explain needs and understand requirements. Underestimating the complexity can lead to costly delays and failure to achieve desired outcomes.

Last but not least: Make sure to have fun and support each other as true team members during this journey. Many who have been part of a large-scale IT and process implementation project refer to it as one of the most challenging and frustrating times in their professional life, but also as one of the most thrilling and developing experiences in their career. 1+1 can certainly be much more than 3 if you manage your large-scale IT implementation well!

Case Study – Finding the optimal position in the value chain for fast charging

The number of electrical vehicles on the market is rapidly increasing, and forecasts show that more than 2.5 million Swedish cars can be chargeable by 2030. Along with the increased number of electric vehicles, the demand for public charging and especially fast charging will increase during the coming years.

During this autumn we supported a publicly owned energy company in Sweden to investigate their optimal position in the value chain for fast charging. To tackle the assignment, we created a large factual basis for what battery electrification looks like in terms of the number of electric vehicles and fast chargers, as well as their location, battery capacity and range. Based on the factual basis and several interviews with representatives from the automotive and energy industry as well as other trade organizations, we forecasted the development of fast charging in Sweden. Furthermore, we mapped the value chain with all included actors and their key success factors. Drawing from this, we were able to help the client to investigate possible choices and positions in the value chain for fast charging. By evaluating the choices and positions with respect to the client´s existing position and capabilities we could find their optimal position and provide them with a roadmap for how to reach that position.

Due to the constantly increasing and changing market for electric vehicles, all publicly owned energy companies will in some way have to decide how to address the charging issue, and especially fast charging will be an interesting subset for most of these actors. This will also be an issue of investigation for many other companies related to the automotive and energy industry.

Are you interested to know more about this topic or do you want help to find your ultimate position in the value chain, don’t hesitate to get in contact with us!

How to understand price changes in the rapidly changing materials market

How do I know if the dramatic price increases from my suppliers are based on actual cost increases or market opportunism?

Montell & Partners and Prognos MKA support companies that seek to enhance their knowledge about cost trends and strengthen their purchasing organizations.

During the last years, the characteristics of the materials market have changed rapidly and the context in which many purchasers operate has become significantly more difficult. Handling large movements and keeping track of price changes is often accomplished by the consultation of price indices and multiple source checking. But what if the sources show contradicting results and how to know what indices accurately display the price changes for your specific products?

Together with our partner Prognos MKA, we have recently arranged several training opportunities for purchasers and management in industries affected by the current price fluctuations. The aim of the training sessions has been to strengthen the knowledge of the participators about price sources and index selection, in order to improve the client’s ability to assess and benchmark their purchasing prices. Our partners Jacob Axenborg and Jacob Mannheimer have also shared their advice on how to best handle specific situations presented to the client, drawing from their experience and expertise in purchasing.

Do you also want to know more about how to find reliable price references for your products? Contact us.

M&A – How to prepare for success

Professor Clayton M. Christensen (et al.) states in Harvard Business Review that “Study after study puts the failure rate of mergers and acquisitions somewhere between 70 % and 90 %”. However, this doesn’t undertake the fact that corporate performance has potential to shoot sky high through successful M&As. We at Montell & Partners have the experience of successfully working with M&A and integrations for over 15 years in Europe, Asia and Africa with great results, meaning that targets have been reached and/or exceeded.

By following three logic steps the success of the integration will be within your control at the same time as risks are minimized:

1. Start by clearly defining the wanted long-term position

It may sound strange, but in the early stages of M&A it’s common to find that the wanted long-term position is unclear and undefined. Make sure to define, secure and anchor the wanted position and establish a detailed business case within the organization.

2. Use the negotiation phase to validate and agree on wanted position, goals and future organization

Include wanted position in Sales Purchase Agreement and utilize success fees connected to the outcome.

3. Perform a strategic due diligence and use this phase to develop a first draft on the business plan, including integration activities

Perform a strategic due diligence and thereby reduce risks of failing in a later stage. By anchoring the joint future business plan with existing organization, it can be aligned with the wanted position before signed contract, which saves valuable time.

Five ways to reduce costs

1. Always be prepared to change suppliers, both mentally and practically

Long supplier relationships can lead to increased costs and prices. A comfortable mindset is easily developed as well as a supplier cooperation set-up that makes it difficult to switch.

2. Invest time in purchasing improvements

Usually, buyers put too much time into administrative and operational work. Yet, challenging current and potential suppliers as well as running improvement projects together with suppliers needs to be prioritized.

3. Divide operational purchasing from strategic purchasing

If these two are not separated or planned well, operational purchasing and the day-to-day activities will always be prioritized over the strategic work. Hence, valuable time is chewed up. Divide these roles either with assigned employees or through a clear division of work time.

4. Run fact-based follow-ups with your suppliers

A large part of the value is added under the control of your suppliers; therefore, it is critical that you support them to always improve their performance. Follow up on KPIs with your strategic suppliers, give specific feedback, and require improvements on a regular basis.

5. Choose your staff wisely and train the purchasing organization

Good purchasing competence as well as recruits with a degree in purchasing can be hard to find. Since purchasing departments are responsible for decisions with large financial impact, consistent training of your purchasing team should be highly prioritized.

R&D Management – Five fundamentals often forgotten

From ”The Machine that Changed the World”, via case books like ”Skunk Works” and ”The Toyota Way”, R&D practitioners and researchers have attempted to spread stories on what tends to work well for developing successful products. Many have read, listened, and learned, but few have really excelled in getting the fundamentals right. In the automotive industry, many companies are now looking at Tesla Inc, which has focused on the key fundamentals, supported by researchers, taken in part from the old learnings of the AeroSpace industry, and adapted to the new Silicon Valley boom in the new millennia. These are five of the key areas that all should learn from.

1. Shorten the distance between your customer and your engineers

In the short term, attentiveness to customer feedback, and having a very short time between errors and their solution, is key. Customers can take problems, as long as they feel they are getting addressed quickly. Managing long-term customer expectations requires communication of goals, which your customers can share and relate to, presenting solutions to their problems, or giving them teasers of the future. Also, customers agree to you collecting and analyzing your customer data, if they feel it will improve their product. Continuously updating and improving the products build a stronger relationship over time.

2. Manage product/part complexity

Complexity is a silent killer. 100 % backward compatibility of new parts, continuous removal of unnecessary parts, and carry-over of parts between product models are key for hardware. The big challenge is however to build a software and electronics infrastructure that allows for maintainability and improvements. Having parameter-controlled updates rather than software builds reduces software complexity to single-digit numbers. This is built on the core philosophy that all vehicles need very few selectable variants (5 colors, two engine set-ups), all equipped from the start with all the hardware functionality you plan to make available during the product life.

3. Rapid internal communication

Cross-functional co-location of people who need day-to-day communication is key. This affects the way the organization is set up and the way the buildings you utilize are built. Smaller is better, big organizations tend to have bigger problems with communication.

“Organizational complexity tends to manifest in the product” – Elon Musk

4. Manage your technical platforms

One example is when the Model Y was launched on the US market in March 2020, it was the first to have a heat pump, utilizing excess heat from using the battery to heat the interior, increasing efficiency during winter by ~25 %. Since then, the heat pump has seen 9 revision changes and has been installed in all the other models. Update and improve the hardware continuously, and manage the interfaces to other parts. This solution was developed for all models from the start, with the complete product family in mind. One solution, less complexity.

5. Invest in your long-term strategies

Investing in battery production and chemistry has proven a core area. The same goes for manufacturing technologies. They are both state of the art in the industry today and have been clearly set strategies from 2014, communicated to both customers and investors. This has driven the recruitment of some of the world’s leading experts in these areas, the incorporation of some leading smaller companies, as well as the selection of suppliers and the location of factories.

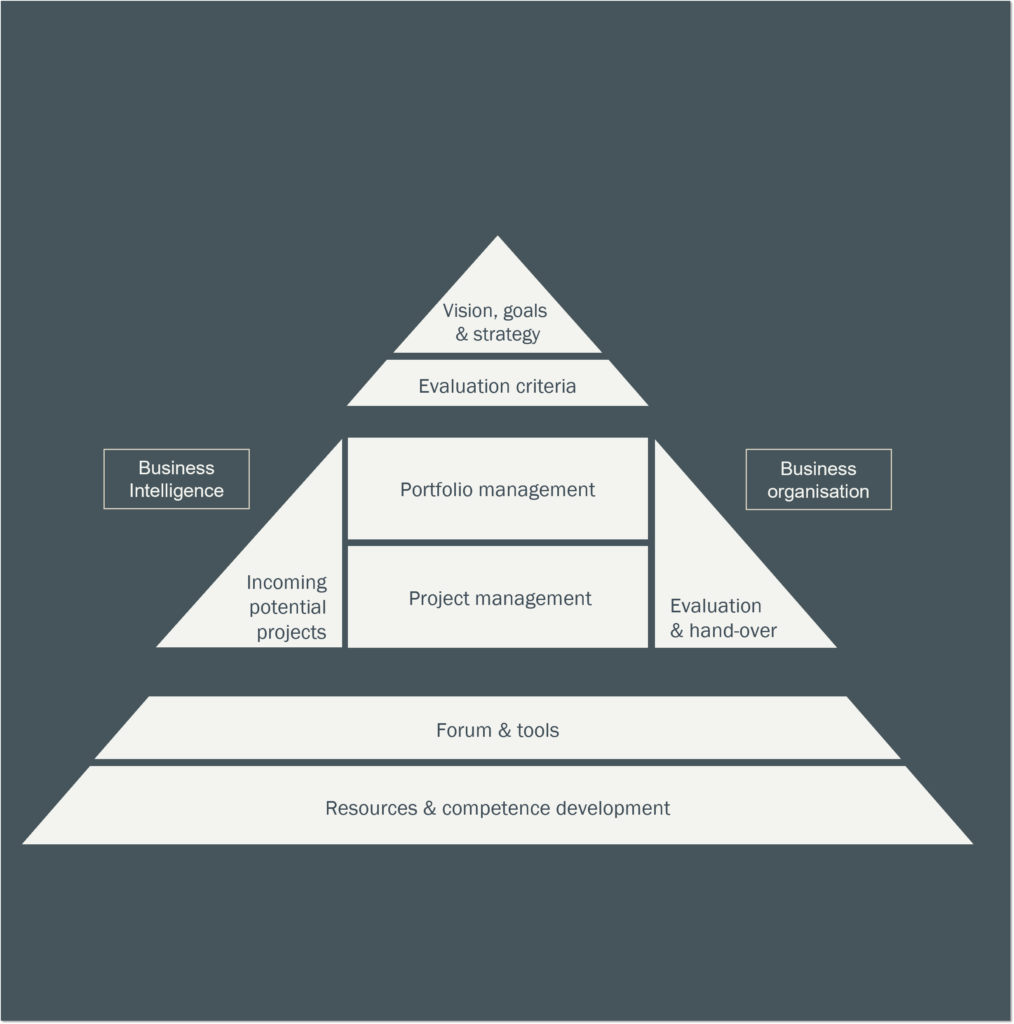

Portfolio Management Framework

Do you feel that the business goals seem further away after each finished project? Perhaps you are focusing on the wrong projects and need to prioritize what your business spends its time on. Montell & Partners has helped multiple companies structure and prioritize incoming projects so they are aligned with the business’s overarching goals. Our framework illustrates how each building block in the business is interlinked.

Are your projects aligned with your company’s strategies and goals? Are you lacking a precise tool for prioritizing incoming projects, leading to inadequate planning and possibly dissatisfied customers as a result?

By setting up a clear method to prioritize your portfolio management, you will be able to free available capacity and leverage your time to focus on the most important projects that significantly impact the bottom-line results as well as contribute to the company’s strategies and goals

The upper part of the framework deals with the connection to the company’s overall goals & strategies and how these are translated into evaluation criteria for the portfolio. The middle part of the framework describes the active management of the portfolio and the projects from start to handover to management. The bottom part is about which forums & tools support the process as well as resource allocation and competence development of involved resources.

Recent posts

Unlocking maximum potential with AI implementations by setting the proper foundations

Artificial intelligence (AI) has evolved to become an increasingly integrated part of our everyday lives. Before exploring how AI can be implemented and create value in organizations, let's first examine what AI is and what advancements have enabled its rapid...

DO’s & DON’Ts – Implementing large-scale IT systems

Implementing large-scale IT systems can seem like an overwhelming task for any organization, especially when working with publicly procured solutions. However, by following the right approach, it can be a highly rewarding experience. Our experienced senior subject...

Case Study – Finding the optimal position in the value chain for fast charging

The number of electrical vehicles on the market is rapidly increasing, and forecasts show that more than 2.5 million Swedish cars can be chargeable by 2030. Along with the increased number of electric vehicles, the demand for public charging and especially fast...

How to understand price changes in the rapidly changing materials market

How do I know if the dramatic price increases from my suppliers are based on actual cost increases or market opportunism? Montell & Partners and Prognos MKA support companies that seek to enhance their knowledge about cost trends and strengthen their purchasing...

M&A – How to prepare for success

Professor Clayton M. Christensen (et al.) states in Harvard Business Review that “Study after study puts the failure rate of mergers and acquisitions somewhere between 70 % and 90 %”. However, this doesn’t undertake the fact that corporate performance has potential to...